In recent times we are now we facing many times about the financial term Credit Score, so this post is basically about the credit score, What is credit score? Why we check the credit score of any person? How to check the credit score online? what information do we get from the credit score? and many queries we are getting in our daily life. So let’s start from the beginning.

What is a Credit Score?

A credit Score is basically a numerical number or you can say a value given to any person, based on his/her credit files. This information basically collected from the credit bureaus.

Who are Credit Bureaus?

Credit Bureaus is basically a data collection agency who is collecting account information of any person from the creditors. Like how you much you are expending from credit cards, loans from banks etc. and rate the person’s history in credit score number.

Why Credit Score is required?

Credit Score gives your reputation to the lenders like credit cards companies or banks like how reliable(Bharose wala person) you are on the basis of your expenses or account history. How regularly you are paying back your dues with banks in the form of loans or dues of credit cards. The higher the credit score the higher the probability you will get new credit cards or new loans(Home Loan, Personal Loan).

Is Credit Score decides the credit limits, rate of interest?

To this, Yes, your credit score decides how and what is your credit history. This your credit score history helps the banks or credit card companies to issue a new credit cards or bank loans to the person or not. How much amount they can give in loan to him or her and on which rate of interest.

This credit score basically shows your finance history of past like how much credit cards you are using?, what is the limit of those credit cards? Are you paying the dues of your credit cards or not? How much times you have not done the payments of the credit cards or emis.

Credit Score Calculating Companies in India

So in India, there are four credit score calculation companies are licensed by Reserve Bank of India. They are named below.

- Credit Information Bureau(India) Limited.

- Experian.

- Equifax.

- CRIF High Mark.

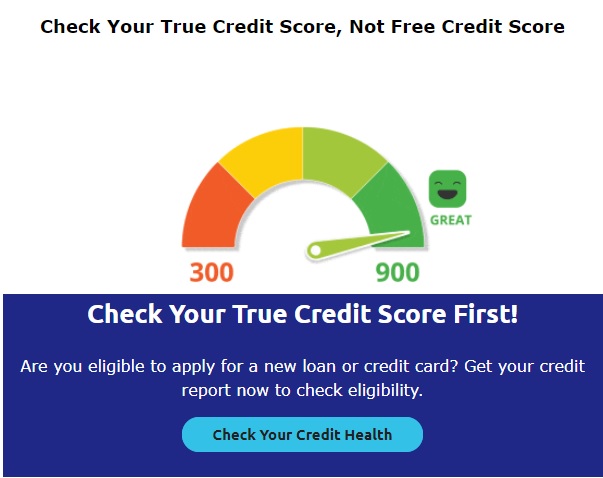

Credit Score Numbers Range

So these credit score calculating companies giving the three digit numbers in below 3 ranges.

- 300- 500, Colour Range is Red meaning Bad Reputation

- 580-750, Colour Range is Amber meaning need some improvement.

- 750-900 or above, Colour range is Green means your are eligible for new credit cards or new loan.