दोस्तों अगर आप एक अच्छी हेल्थ इंस्युरेन्स अपने लिए या अपने परिवार जनो के लिए ढूंढ रहे हैं तो ये पोस्ट आपको जरूर देखना चाहिए। इस पोस्ट में हम भारत में सबसे अच्छी हेल्थ पालिसी के बारे में सारी जानकारी है। किसी भी हेल्थ इंस्युरेन्स को खरीदने से पहले किन बातों पर धयान देना चाहिए वो सभी इस पोस्ट में बताया गया है। आप भी इस पोस्ट को पूरा पढ़ें और अपने पैसे सही जगह इन्वेस्ट करें जिससे आप अपना पैसे और सेहत दोनों बचाओ।

एक अच्छा हेल्थ प्लान आप और आप के परिवार पर आने वाले भविष्य के संकट से आप को सुरक्षित रखता है। क्या है “Optima Secure ” और इसका क्या क्या फायदा है कैसे आपको और आपके परिवार को किसी भी सेहत से सम्बंधित परेशानियों से बचा सकता है साडी डिटेल्स है।

HDFC ERGO Optima Secure

Optima Secure is one of the best health Insurance plan in India. This is one of the best selling plan launched by HDFC ERGO. HDFC ERGO is one of the pioneer in health insurance sectore, HDFC ERGO has take over Apollo Munich in year 2020 and now India’s top selling Health Insurance Company.

पिछले दो वर्षों से एक अच्छे हेल्थ प्लान की जरुरत सबको होने लगी है जिसका सबसे बड़ा कारण CORONA है , इस bimari की वजह से कीनो लोगों ने अपनों को खोया है। कोरोना के वजह से लोगों को काफी आर्थिक बोझ के टेल दबा दिया, लोगों ने तो अपनों को खोया सो अलग आर्थिक परेशानियों ने भी काफी तबाह किया। इस तरह के परेशानियों के बचने के लिए हम सभी के पास एक अच्छा हेल्थ प्लान होना चाहिए जिसके लिए – HDFC ERGO Optima Secure is the Best plan to choose.

Key Features of Optima Secure

- Base Sum Insured – 5Lakhs/10Lakhs/15Lakhs/20Lakhs/25Lakhs/50Lakhs/100 Lakhs/200Lakhs

- Room Rent – Sum insured Less than 50 Lakhs single AC Private Room. Sum Insured more than 50Lakhs All room types.

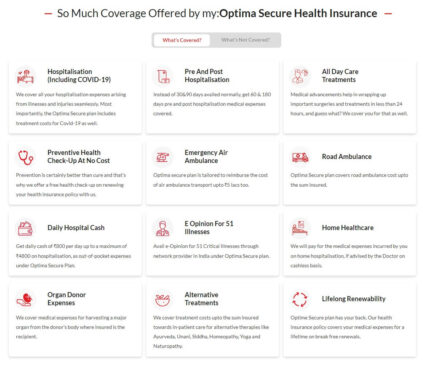

- Cover Completely on Selected Plans – Hospitalization expenses, AYUSH Treatment, Home Healthcare, Organ Donar Expenses, Pre-Hospitalization 60 days, Post-Hospitalization 18- days.

- Secure Beenfits – 100% of Sum Insured.

- Protect Benefit – UPTO Sum Insured.

- Plus Benefit – Irrespective of Claim status, increase of 50% of Base Sum Insured in a policy year and maximum up to 100%.

- Restore Benefits – Upto 100% of Base Sum Insured for any illness any insured person.

- Emegency Ambulance – Road Upto Sum Insured, Air Upto -Rs.5,00,000.

- Daily Cash for Chossing Shared Accomodation – Rs.800 per day.

- Tax Saving – Get Income Tax Benefits under section 80D of Income Tax Act

Benefits of HDFC ERGO Optima Secure

- Secure Benefit – 2X coverage from Day 1. The base cover you opt for get double once you pay the premium automaticallly without any additional cost. No Hidden charges No extra charges. Means if you take a policy of base sum assure of Rs. 10 Lakhs you will get benefits of Rs.20 Lakhs from the first Day.

- Plus benefits – 100% increase in coverage after 2 years. The base cover increase 50% after one year and 100% after the second year if the policy is running without lapse.

- Restore Benefits – 100% restore coverage. If claim made 100% of the amount get restored in the policy itself.

- Protect Benefits – Non-Medical Expenses. means 0 deduction on listed non-medical expenses, that means we cover and pay the list of Non-Medical expenses in the policy itself. Means Go cashless with in-built coverage for disposable items like gloves, masks, food charges and other consumables during hospitalization

- E-opininon for critical illeness – HDFC ERGO will pay the extra expenses which incurred if you choose e-opinion for critical illness from the top doctors of network hospitals.

- No Geography based copayment – No matter where you choose to get treated. We don’t require copayment.

- Daily Cash – HDFC ERGO will give daily cash of Rs 800 per day and maximum upto Rs 4800 if you choose shared room/accomodation for more than 48 hrs.

Waiting Period in Optima Secure

Every health insurance has some waiting period, hence HDFC ERGO also has 30 days waiting period from the 1 policy but no waiting period in an accidental emergency. Customers can use health insurance immediately after the issuance of a health policy and will be covered if he/she meets some accident. So accidental cases were covered immediately.

- 30 days waiting period for hospitalisation other than accidental injuries.

- 24 months waiting period on specific illness and surgical procedures.

- 36 months waiting periods on pre-existing diseases.

What are not covered?

- Abuse of intoxicant or hallucinogenic substances like drugs and alcohol.

- Pregnancy, dental treatement, external aids and appliances.

- Hospitalization due to war or an act of war or due to nuclear chemical or biological weapon and radiations of any kind.

- Congential external diseases, cosmetic surgery and weight control treatments.

Why To Choose HDFC ERGO?

- ~10,000 hospitals in network to give cashless treatment.

- 1.5 Crores Happy Customers.

- 1 Claim settled every Minute*.

- 97% Claim settlement Ratio.

- 7500 Crore Claim settled till now.

- 24X7 inhouse claim support.